REU Math UConn 2025 abstract basilica

REU Math UConn 2025 abstract Sierpinski

REU_Math_UConn_2025 Dirichlet talk

REU_Math_UConn_2025 Dirichlet text

June 9, 2025

May 23, 2024

Topics: Laplacian Eigenmaps, Orthogonal Polynomials, Quantum Information

Participants:

Farabie Akanda; Haverford College

Elijah Anderson; Wesleyan University

Elizabeth Athaide; Massachusetts Institute of Technology

Faye Castro; Texas State University

Sara Costa; University of Hartford

Leia Donaway; Swarthmore College

Hank Ewing; Appalachian State University

Caleb Findley; University of Texas at Arlington

August Noë; University of California Santa Cruz

Sam Trombone; Hamilton College

Kai Zuang; Brown University

and

John Ackerman; UConn

Mentors:

Bernard Akwei, Rachel Bailey, Maxim Derevyagin, Luke Rogers, Alexander Teplyaev

Final Presentation: Perfect State Transfer in Cycle Graphs – Elizabeth Athaide, Leia Donaway and Sam Trombone

Poster: PST in Cycles Poster

Final Presentation: Early State Exclusion Slides- Sara Costa, Caleb Findley, Kai Zuang

August 3, 2023

Jason Freitas and Joshua Huang

Mentor: Oleksii Mostovyi

May 18, 2023

REU participants:

Bobita Atkins, Massachusetts College of Liberal Arts

Ashka Dalal, Rose-Hulman Institute of Technology

Natalie Dinin, California State University, Chico

Jonathan Kerby-White, Indiana University Bloomington

Tess McGuinness, University of Connecticut

Tonya Patricks, University of Central Florida

Genevieve Romanelli, Tufts University

Yiheng Su, Colby College

Mentors: Bernard Akwei, Rachel Bailey, Luke Rogers, Alexander Teplyaev

Convergence, optimization and stabilization of singular eigenmaps

B.Akwei, B.Atkins, R.Bailey, A.Dalal, N.Dinin, J.Kerby-White, T.McGuinness, T.Patricks, L.Rogers, G.Romanelli, Y.Su, A.Teplyaev

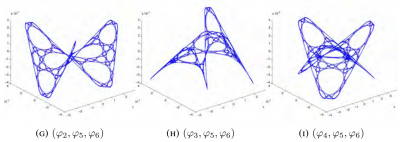

Eigenmaps are important in analysis, geometry and machine learning, especially in nonlinear dimension reduction.

Versions of the Laplacian eigenmaps of Belkin and Niyogi are a widely used nonlinear dimension reduction technique in data analysis. Data points in a high dimensional space \(\mathbb{R}^N\) are treated as vertices of a graph, for example by taking edges between points separated by distance at most a threshold \(\epsilon\) or by joining each vertex to its \(k\) nearest neighbors. A small number \(D\) of eigenfunctions of the graph Laplacian are then taken as coordinates for the data, defining an eigenmap to \(\mathbb{R}^D\). This method was motivated by an intuitive argument suggesting that if the original data consisted of \(n\) sufficiently well-distributed points on a nice manifold \(M\) then the eigenmap would preserve geometric features of \(M\).

Several authors have developed rigorous results on the geometric properties of eigenmaps, using a number of different assumptions on the manner in which the points are distributed, as well as hypotheses involving, for example, the smoothness of the manifold and bounds on its curvature. Typically, they use the idea that under smoothness and curvature assumptions one can approximate the Laplace-Beltrami operator of \(M\) by an operator giving the difference of the function value and its average over balls of a sufficiently small size \(\epsilon\), and that this difference operator can be approximated by graph Laplacian operators provided that the \(n\) points are sufficiently well distributed.

In the present work we consider several model situations where eigen-coordinates can be computed analytically as well as numerically, including the intervals with uniform and weighted measures, square, torus, sphere, and the Sierpinski gasket. On these examples we investigate the connections between eigenmaps and orthogonal polynomials, how to determine the optimal value of \(\epsilon\) for a given \(n\) and prescribed point distribution, and the dependence and stability of the method when the choice of Laplacian is varied. These examples are intended to serve as model cases for later research on the corresponding problems for eigenmaps on weighted Riemannian manifolds, possibly with boundary, and on some metric measure spaces, including fractals.

Approximation of the eigenmaps of a Laplace operator depends crucially on the scaling parameter \(\epsilon\). If \(\epsilon\) is too small or too large, then the approximation is inaccurate or completely breaks down. However, an analytic expression for the optimal \(\epsilon\) is out of reach. In our work, we use some explicitly solvable models and Monte Carlo simulations to find the approximately optimal value of \(\epsilon\) that gives, on average, the most accurate approximation of the eigenmaps.

Our study is primarily inspired by the work of Belkin and Niyogi “Towards a theoretical foundation for Laplacian-based manifold methods.”

Talk: Laplacian Eigenmaps and Chebyshev Polynomials

Talk: A Numerical Investigation of Laplacian Eigenmaps

Talk: Analysis of Averaging Operators

Intro Text: Graph Laplacains, eigen-coordinates, Chebyshev polynomials, and Robin problems

Intro Text: A Numerical Investigation of Laplacian Eigenmaps

Intro Text: Comparing Laplacian with the Averaging Operator

Poster: Laplacian Eigenmaps and Orthogonal Polynomials

Results are presented at the 2023 Young Mathematicians Conference (YMC) at the Ohio State University, a premier annual conference for undergraduate research in mathematics, and at the 2024 Joint Mathematics Meetings (JMM) in San Francisco, the largest mathematics gathering in the world.

March 22, 2023

Group Members: Tyler Campos, Andrew Gannon, Benjamin Hanzsek-Brill, Connor Marrs, Alexander Neuschotz, Trent Rabe and Ethan Winters.

Mentors: Rachel Bailey, Fabrice Baudoin, Masha Gordina

Overview: We study and simulate on computers the fractional Gaussian fields and their discretizations on surfaces like the two-dimensional sphere or two-dimensional torus. The study of the maxima of those processes will be done and conjectures formulated concerning limit laws. Particular attention will be paid to log-correlated fields (the so-called Gaussian free field).

July 9, 2022

University of Wisconsin-Madison, USA

University of Notre Dame, USA

Harvard University, Cambridge, USA

University of Connecticut, Storrs, USA

July 6, 2022

Involve (2022), Vol. 15(4), pp. 649-668. [published version] [arXiv]

July 9, 2020

accepted in the Missouri Journal of Mathematical Sciences (2023)

July 8, 2020

Séminaire Lotharingien de Combinatoire (2021)

Sém. Lothar. Combin. 85B (2021), Art. 14, 12 pp.

Proceedings of the 33rd Conference on Formal Power

Series and Algebraic Combinatorics

Ben Drucker, Eli Garcia, Emily Gunawan, and Rose Silver

A box-ball system is a collection of discrete time states representing a permutation,

on which there is an action called a BBS move. After a finite number of BBS moves

the system decomposes into a collection of soliton states; these are weakly

increasing and invariant under BBS moves. The students proved that when this

collection of soliton states is a Young tableau or coincides with a partition of a type

described by Robinson-Schensted (RS), then it is an RS insertion tableau. They also

studied the number of steps required to reach this state.

August 3, 2019

Sarah Boese, Tracy Cui, Sam Johnston

Gianmarco Molino, Olekisii Mostovyi

In practice, financial models are not exact — as in any field, modeling based on real data introduces some degree of error. However, we must consider the effect error has on the calculations and assumptions we make on the model. In complete markets, optimal hedging strategies can be found for derivative securities; for example, the recursive hedging formula introduced in Steven Shreve’s “Stochastic Calculus for Finance I” gives an exact expression in the binomial asset model, and as a result the unique arbitrage-free price can be computed at any time for any derivative security.

In incomplete markets this cannot be accomplished; one possibility for computing optimal hedging strategies is the method of sequential regression. We considered this in discrete-time; in the (complete) binomial model we showed that the strategy of sequential regression introduced by Follmer and Schweizer is equivalent to Shreve’s recursive hedging formula, and in the (incomplete) trinomial model we both explicitly computed the optimal hedging strategy predicted by the Follmer-Schweizer decomposition and we showed that the strategy is stable under small perturbations.